vermont sales tax on alcohol

PA-1 Special Power of Attorney. The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax.

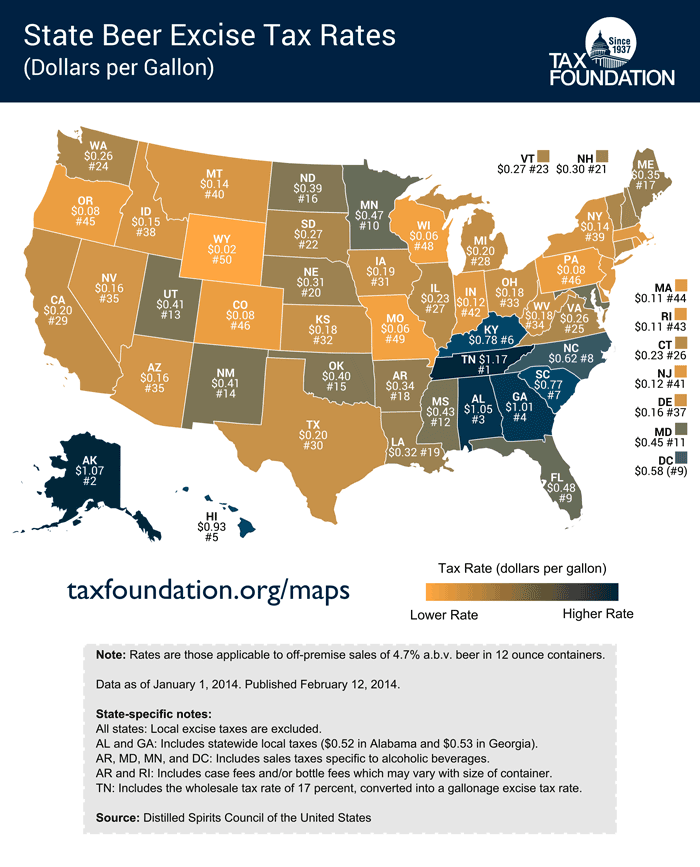

These States Have The Highest And Lowest Alcohol Taxes

On the other hand alcohol tariffs are based on the amount of liquid weight that is purchased.

. Vermont has a statewide sales tax rate of 6 which has been in place since 1969. The state of Arkanas adds an excise tax of 250 per gallon on spirits. The Essex Junction Sales Tax is collected by the merchant on all qualifying sales made within Essex Junction.

June 17 1994 provided. We have provided a table to help guide you on page 2. For example in Massachusetts the state levies a 1025 excise tax on marijuana products.

Depending on local municipalities the total tax rate can be as high as 7. While many other states allow counties and other localities to collect a local option sales tax Vermont does not permit local sales taxes to be collected. Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6.

There are a total of 154 local tax jurisdictions across the state collecting an average local tax of 0156. The tax rate is 6. Select the Vermont city from the list of popular cities below to see its current sales tax rate.

45 rows The sales tax rate is 6. Simplify Vermont sales tax compliance. Beer and wine are subject to Vermont sales taxes.

Sales Tax A sales tax of 6 is imposed on the retail sales of. Missouri has a 4225 statewide sales tax rate but also has 731 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 3667 on top of the state tax. Local sales taxes can bring the total to 7.

Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. Vermont sales tax reference for quick access to due dates contact info and other tax details. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1.

In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 1. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

Vermont Business Magazine As spring temperatures arrive the Vermont Department of Environmental Conservation DEC is inviting Vermonters to report when lakes and ponds lose their ice cover known as the ice-out dateThe spring date when a lake becomes completely ice free from shore to shore lets DEC staff scientists know the best time to begin. The tax on any alcohol. IN-111 Vermont Income Tax Return.

Thus the sales tax on alcohol can be as high as 121. Average Sales Tax With Local. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services.

0183 per gallon. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. Beverage alcohol Manage beverage alcohol regulations and tax rules.

Vermont has recent rate changes Fri Jan 01 2021. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. Sess 283 eff.

Liquor sales are only permitted in state alcohol stores also called ABC Stores. With local taxes the total sales tax rate is between 6000 and 7000. Alcohol used to be exempt but a 6 state sales tax was added to all alcohol and liquor sales in April 2009.

62 or any other provision of law the liquor control board shall issue regulations permitting the retail sale of spirituous liquor on Sundays by any licensed agency or state liquor store. We provide sales tax rate databases for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales tax calculation and filing process. Vermont Alcoholic Beverage Sales Tax 87238 KB File Format.

This means that an individual in the state of Vermont purchases school supplies and books for their children. A local option tax allows for a 1 percent additional tax on Vermonts sales meals rooms and alcohol beverage taxes which would turn into collectible revenue for the municipality. Direct Ship to Retail.

An example of items that are exempt from Vermont sales tax are items specifically purchased for resale. The state sales tax rate in Vermont is 6000. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities.

Raised from 6 to 7. Liquefied Natural Gas LNG 0243 per gallon. W-4VT Employees Withholding Allowance Certificate.

The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax. SNAP or food stamps are exempt from sales tax. In Vermont this is the 3SquaresVT program.

The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on. Other local-level tax rates in the state of Vermont are quite complex compared against local-level tax rates in other states. Effective June 1 1989.

Liquor sales are only permitted in state alcohol stores also called ABC Stores. In essence the actual tax rates in the town of Shelburne for alcoholic beverages 10 percent meals 9 percent and sales 6 percent would all increase by one. The tax on beer is 23 cents and on wine its 75 cents.

Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Skip to main content. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax.

Permitted sale of liquor on Sundays. Alcoholic Beverage Sales Tax. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax.

The state sales tax is 6. Sales and Use Tax 32 VSA. Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled.

The Vermont VT state sales tax rate is currently 6. Federal excise tax rates on various motor fuel products are as follows. This comes in addition to the local option tax of up to 3 and the states 625 sales tax according to MassLive.

For beverages sold by holders of 1st or 3rd class liquor licenses. The best way to determine whether a beverage falls under the definition of a soft drink is to read the product label.

The Remnants Of Prohibition Prohibition An Interactive History

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

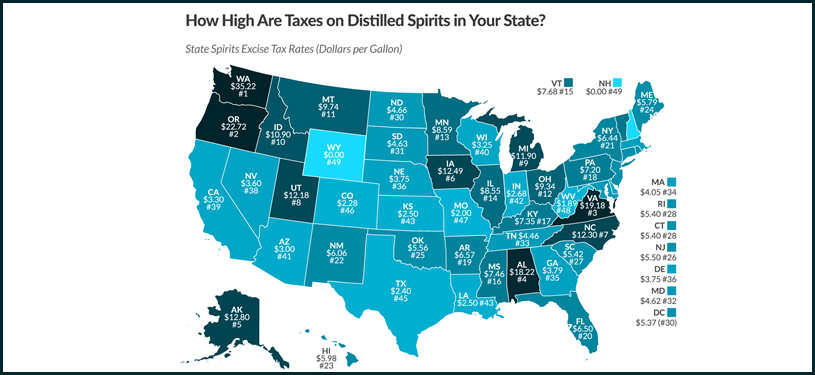

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

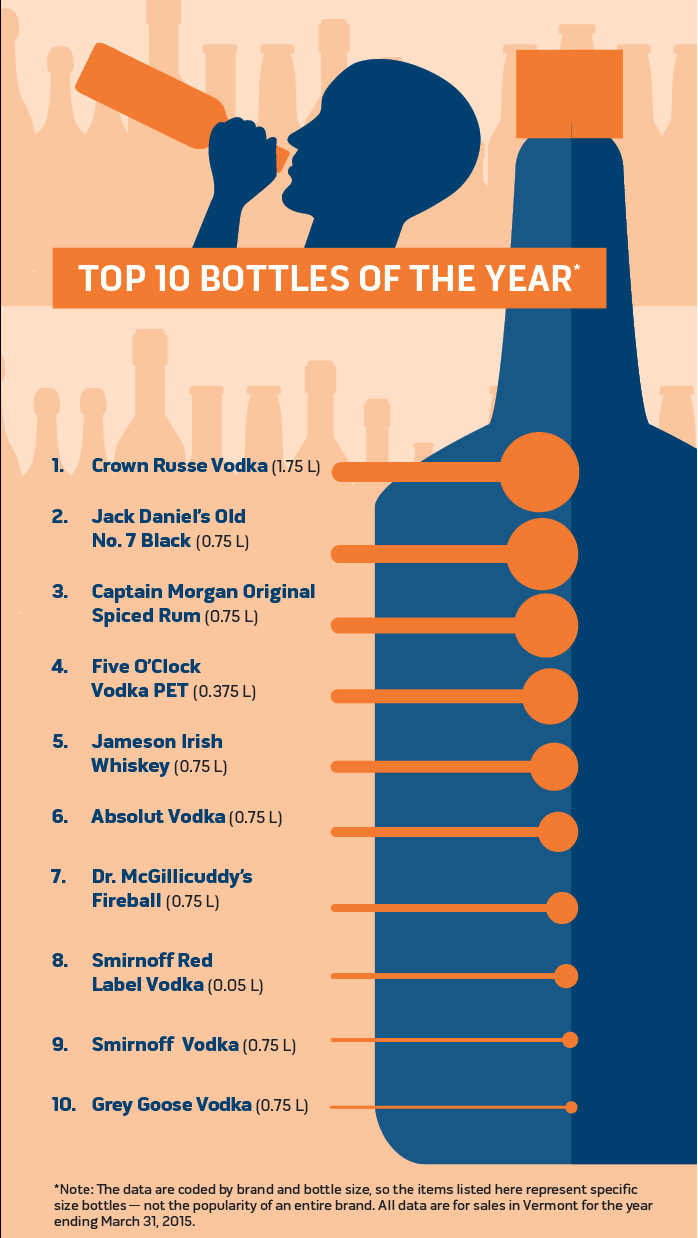

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Alcohol Vs Cannabis Taxes Leafbuyer

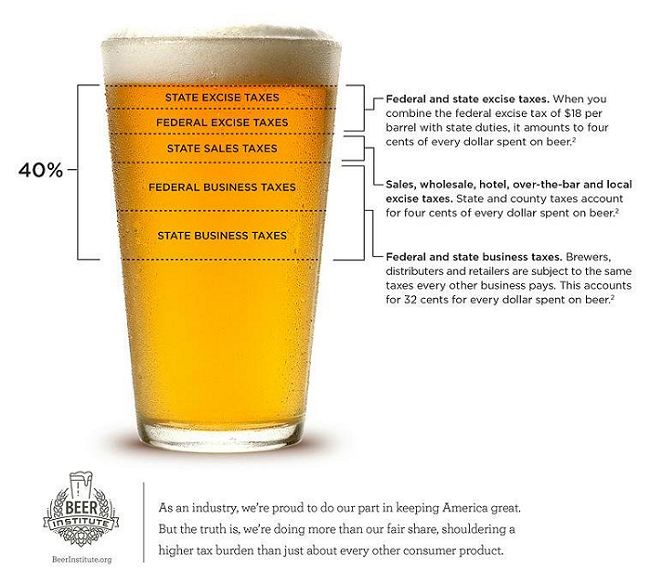

Alcohol Taxes On Beer Wine Spirits Federal State

By The Numbers North Carolina Ranks 6th Highest On Alcohol Taxes North Carolina Thecentersquare Com

Spirits Industry Pushes For States To Lower Taxes On Canned Cocktails

These States Have The Highest And Lowest Alcohol Taxes

Alcohol Taxes On Beer Wine Spirits Federal State

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

When Did Your State Adopt Its Sales Tax Tax Foundation

Alcohol Taxes On Beer Wine Spirits Federal State

Vermont Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Alcohol Taxes On Beer Wine Spirits Federal State